SF 1034 1987-2024 free printable template

Show details

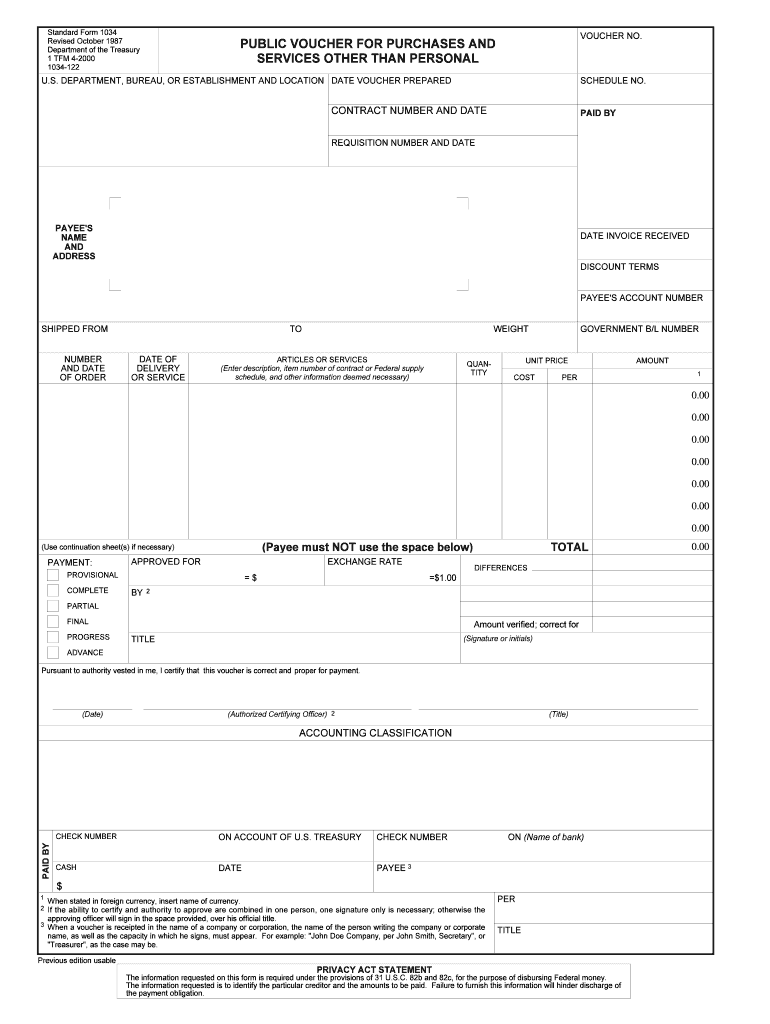

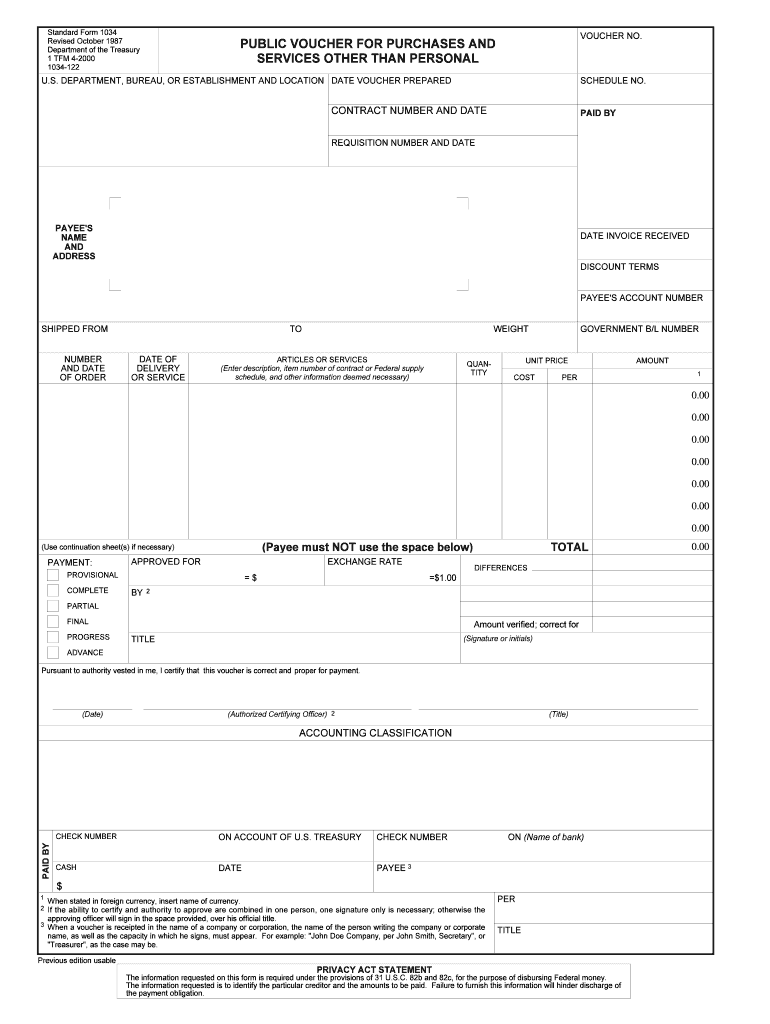

Standard Form 1034 Revised October 1987 Department of the Treasury 1 TFM 4-2000 1034-122 VOUCHER NO. PUBLIC VOUCHER FOR PURCHASES AND SERVICES OTHER THAN PERSONAL U*S* DEPARTMENT BUREAU OR ESTABLISHMENT AND LOCATION DATE VOUCHER PREPARED SCHEDULE NO. CONTRACT NUMBER AND DATE PAID BY REQUISITION NUMBER AND DATE PAYEE S NAME AND ADDRESS DATE INVOICE RECEIVED DISCOUNT TERMS PAYEE S ACCOUNT NUMBER SHIPPED FROM NUMBER AND DATE OF ORDER TO DATE OF DELIVERY OR SERVICE WEIGHT ARTICLES OR SERVICES...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 1034 1987-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1034 1987-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1034 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sf 1034 instructions form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

SF 1034 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1034 1987-2024 form

How to fill out treasury department:

01

Identify the objectives and goals of the treasury department, which may include managing cash flows, optimizing working capital, and mitigating financial risks.

02

Determine the organizational structure of the treasury department, including the roles and responsibilities of each team member.

03

Develop and implement treasury policies and procedures to govern financial activities such as cash management, liquidity management, debt management, and foreign exchange.

04

Establish relationships with banks and financial institutions to ensure access to appropriate banking services and funding sources.

05

Implement treasury systems and technology to streamline and automate treasury processes, enhance data visibility and reporting, and improve operational efficiency.

06

Monitor and analyze key financial metrics and market trends to make informed decisions and recommendations to optimize treasury activities.

07

Collaborate with other departments within the organization, such as finance, accounting, and risk management, to ensure alignment and effective coordination of financial activities.

08

Continuously evaluate and improve treasury practices by staying updated on industry best practices and adopting innovative solutions.

Who needs treasury department:

01

Large corporations with complex financial operations and significant cash flows require a treasury department to effectively manage their finances and mitigate financial risks.

02

Financial institutions, including banks and insurance companies, rely on treasury departments to ensure liquidity and manage investment portfolios.

03

Government entities and public institutions also need treasury departments to manage their cash flows, debt financing, and investment activities.

04

Non-profit organizations and charities often have treasury departments to responsibly manage and allocate their funds for achieving their missions.

05

Small and medium-sized enterprises (SMEs) may also benefit from having a treasury department, especially if they operate in industries with high financial volatility or have international operations.

Video instructions and help with filling out and completing 1034

Instructions and Help about what is sf 1034 used for form

Fill standard form 1034 public voucher : Try Risk Free

People Also Ask about 1034

What is the difference between IRS and Department of Treasury?

What are 3 things the Department of Treasury does?

What does a treasury department do?

How do I know if I owe the Department of Treasury?

Where is U.S. Treasury Department located?

What is the Department of Treasury used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is treasury department?

The Treasury Department is a federal government agency that is responsible for managing the United States government's financial assets, issuing public debt, and producing coin and currency. The Treasury Department also serves as the government's fiscal agent, collecting taxes and other payments, managing government accounts, and providing services to other government agencies.

Who is required to file treasury department?

The Treasury Department requires certain businesses and individuals to file reports on various forms, including Form 8300, Form TD F 90-22.1, and Form FinCen 114. These reports are required for certain transactions related to money laundering, terrorist financing, and other financial crimes.

What is the purpose of treasury department?

The purpose of the treasury department is to manage the finances of the government and ensure the soundness of the financial system. The department is responsible for collecting taxes, managing the public debt, issuing currency, supervising national banks, and providing economic and financial advice to the President and Congress.

How to fill out treasury department?

Filling out the treasury department involves the process of hiring and staffing individuals for various positions within the department. Here are the steps to fill out the treasury department:

1. Identify the positions needed: Determine the roles and positions required to run the treasury department effectively. This may include positions such as treasurer, financial analyst, cash management specialist, risk management officer, accountant, and tax specialist.

2. Define job descriptions: Create detailed job descriptions that outline the responsibilities, qualifications, and experience required for each position. These job descriptions will help attract the right candidates and assist in evaluating applicants.

3. Advertise the positions: Publicize job vacancies through various channels such as online job portals, industry-specific websites, professional associations, careers pages, and social media platforms. Specify necessary qualifications, application deadlines, and provide contact information for interested applicants.

4. Review applications: Screen the received applications to shortlist candidates who meet the qualifications outlined in the job descriptions. Consider their experience, education, skills, and other relevant criteria specified in the job posting.

5. Conduct interviews: Schedule interviews with the shortlisted candidates to assess their suitability for the positions. These interviews may involve a panel of interviewers including representatives from the treasury department and other relevant stakeholders within the organization.

6. Assess skills and compatibility: During the interview process, evaluate candidates' technical skills, industry knowledge, problem-solving abilities, and cultural fit within the organization. This helps ensure that the selected individuals can effectively contribute to the department's goals and work well with existing team members.

7. Perform background checks: Conduct background checks on the final candidates to verify their qualifications, experience, and references provided in their application. This step helps to confirm the applicants' credibility and reliability.

8. Make job offers: Based on the evaluation of candidates and their background checks, extend job offers to the selected individuals. Clearly communicate the terms and conditions of employment, compensation packages, and any other relevant details.

9. Onboarding and training: Once the candidates accept the job offers, initiate the onboarding process. Provide them with the necessary paperwork, introduce them to colleagues, and ensure they receive appropriate training to familiarize themselves with their roles, responsibilities, and the overall functioning of the treasury department.

10. Monitor and support: After the new hires join the treasury department, consistently monitor their performance and provide support as needed. Conduct periodic evaluations and address any concerns or opportunities for growth.

What information must be reported on treasury department?

There are several types of information that must be reported to the Treasury Department. The specific details may vary depending on the specific reporting requirements and regulations, but some common information that needs to be reported includes:

1. Financial transactions: The Treasury Department requires reporting of various financial transactions, such as receipts, disbursements, investments, loans, and grants.

2. Cash balances: Organizations must report their cash balances, including details of the accounts held, the amount of cash, and any changes in cash balances over a given period.

3. Debt and borrowing: Entities that have borrowed money or issued debt securities are required to report details of the debt obligations, including the principal amounts, interest rates, maturity dates, and any covenants or guarantees associated with the debt.

4. Foreign transactions: Reporting of foreign transactions and financial activities is a crucial requirement for individuals, organizations, and businesses engaged in international trade or financial transactions. This may include reporting of foreign bank accounts, investments, or transactions with foreign entities.

5. Tax-related information: The Treasury Department requires reporting of various tax-related information, such as income, deductions, credits, and other financial details necessary to compute and report taxes owed.

6. Money laundering and anti-terrorism: Financial institutions are required to report suspicious transactions or activities that may indicate money laundering, terrorist financing, or other illegal activities. These reports help in preventing and combating financial crimes.

7. Sanctions compliance: Organizations engaged in international transactions need to comply with various economic sanctions and embargo programs. Reporting to the Treasury Department is necessary to ensure compliance with these regulations.

8. Corporate governance and compliance: Some reporting requirements by the Treasury Department pertain to corporate governance and compliance matters, including details of board members, executive compensation, related-party transactions, and other disclosures required by law or regulatory bodies.

These are just some examples of the information that may need to be reported to the Treasury Department. The specific reporting requirements can vary based on the nature and type of the organization, financial activities, and local regulations.

What is the penalty for the late filing of treasury department?

The penalty for the late filing of treasury department forms varies depending on the specific form and the length of the delay. In general, the penalties can range from a flat amount to a percentage of the unpaid tax due, with additional interest accruing on the balance. It is best to consult the specific instructions for each form to determine the specific penalties and interest rates applicable for late filing.

How can I modify 1034 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your sf 1034 instructions form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send sf 1034 to be eSigned by others?

When you're ready to share your sf1034 pdf, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit sf1034 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sf 1034 example form, you need to install and log in to the app.

Fill out your 1034 1987-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sf 1034 is not the form you're looking for?Search for another form here.

Keywords relevant to standard form 1034

Related to 1034 public

If you believe that this page should be taken down, please follow our DMCA take down process

here

.